HUF Legal deed and Pan card creation Steps

A Hindu Undivided Family (HUF) is a unique legal and tax entity in India designed for Hindu families. It is based on the concept of a joint family where multiple generations live together and share family assets. Also this setup can also include Buddhists, Jains, and Sikhs.

The HUF is managed by the eldest male family member, known as the Karta. The family can own properties or assets that come from:

- Ancestral property (passed down through generations).

- Gifts received by the family.

- Proceeds from selling joint family assets.

- Inheritance through a will.

HUFs are often used to manage family wealth and take advantage of tax benefits.

Steps to Create a HUF and Get a PAN Card

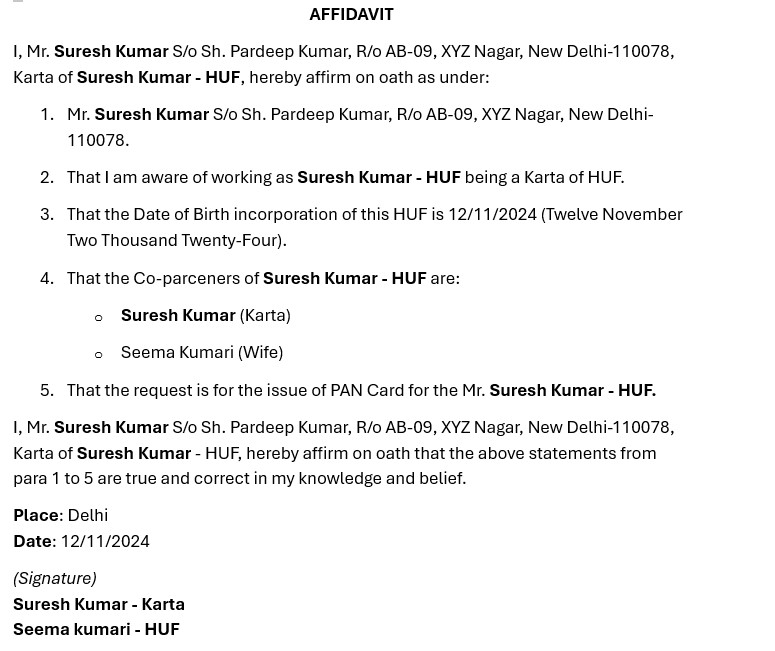

1. Create a Legal Deed

- Draft a legal deed on ₹100 stamp paper, detailing all members of the HUF.

- Include the name of the Karta and other co-parceners (family members part of the HUF).

- Specify the “Date of Birth/Incorporation” of the HUF.

Example:

Suresh Kumar (Karta) and his wife Seema Kumari wish to create an HUF. Their legal deed will include these details.

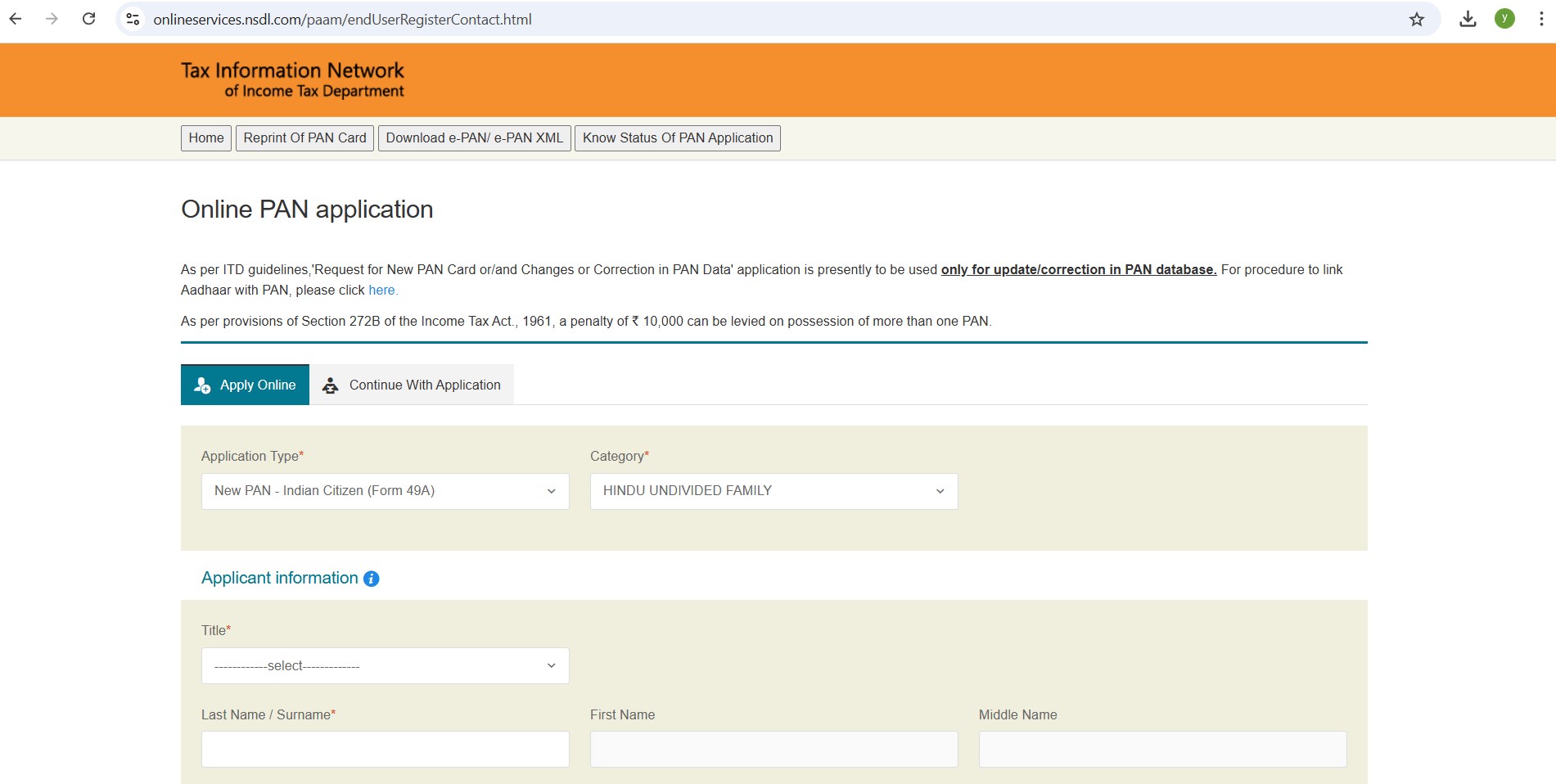

2. Apply for a HUF PAN Card

- Visit the PAN Application Website: NSDL PAN Application Portal

:

- Fill in the Application Form:

- Application Type: New PAN – Indian Citizen (Form 49A)

- Category: Hindu Undivided Family (HUF)

- Date of Birth/Incorporation: Use the date mentioned in the deed (e.g., “Date of Birth Incorporation”).

- Pay the fee (approximately ₹100).

Once submitted, you will receive an acknowledgment receipt via email.

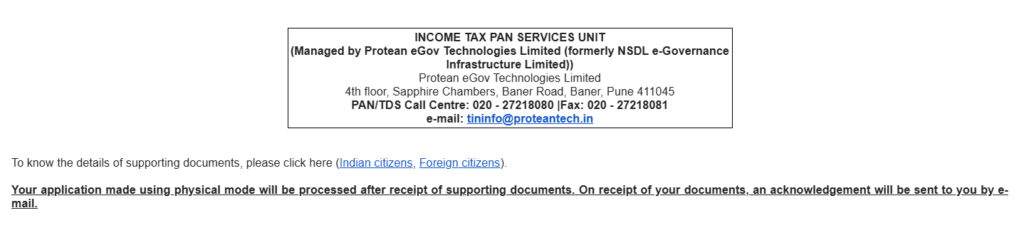

3. Mail/Post Documents

Send the following documents to the Income Tax PAN Services Unit:

- A self-attested copy of the legal deed.

- A self-attested copy of the submitted PAN application form.

- A copy of the acknowledgment receipt received after online submission.

- Proof of identity (e.g., Aadhar card of the Karta).

Post Address you will get on acknowledgement email as below:

4. Receive PAN Card

- After verification, you will receive an E-PAN card via email.

- A physical PAN card will be delivered to your registered address a few days later.

Next Steps

Once you have the PAN card for your HUF, you can open a new bank account in the name of the HUF. This allows you to start using the HUF for financial and tax purposes.

With these simple steps, your HUF is ready to function as a separate legal and financial entity!